Infrastructure investment due diligence

On behalf of a Canadian oilseed processer WPI's team provided market analysis, econometric modeling and financial due diligence in support of a $24 million-dollar investment in a Ukrainian crush plant. Consistent with WPI's findings, local production to supply the plant and the facility's output have expanded exponentially since the investment. WPI has conducted parallel work on behalf of U.S., South American and European clients, both private and public, in the agri-food space.

USDA will release its Cattle on Feed report tomorrow; the consensus pre-report analysts’ estimate is for the inventory of cattle on feed as of 1 April to be 102 percent of last year; this would be the seventh consecutive month that inventories were equal to or larger than the previous yea...

USDA will release its Cattle on Feed report tomorrow; the consensus pre-report analysts’ estimate is for the inventory of cattle on feed as of 1 April to be 102 percent of last year; this would be the seventh consecutive month that inventories were equal to or larger than the previous yea...

The CBOT was mixed on Wednesday with wheat futures dropping amid fund selling due to a stronger U.S. dollar and easing Russian FOB offers while corn drifted lower in lackluster, low-volume trade. While the grains were on the defensive, the soy complex found some support from technically related...

The CBOT was mixed on Wednesday with wheat futures dropping amid fund selling due to a stronger U.S. dollar and easing Russian FOB offers while corn drifted lower in lackluster, low-volume trade. While the grains were on the defensive, the soy complex found some support from technically related...

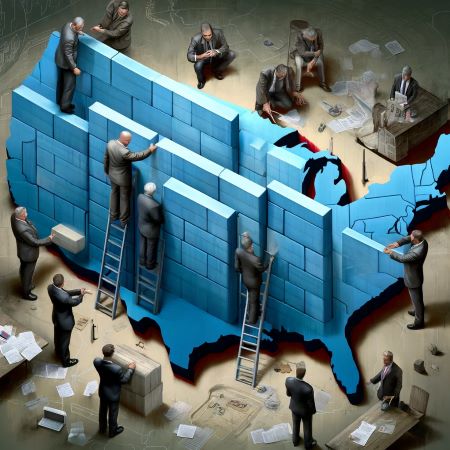

A Washington International Trade Association discussion on trade policy with former officials from both the Trump and Biden administrations reinforced the bipartisan agreement on some trade policies. A day after House GOP representatives slammed USTR Katherine Tai for the Biden Administration&r...

A Washington International Trade Association discussion on trade policy with former officials from both the Trump and Biden administrations reinforced the bipartisan agreement on some trade policies. A day after House GOP representatives slammed USTR Katherine Tai for the Biden Administration&r...