SPREADS

May crush trades to 91.22c/bu, while oilshare is weaker, trading back below 34.0% to 33.87%. Corn spreads weaken with July/Dec trading out to 3c from 2 1/4c. March/May corn trades from 4 1/4c to 4 1/2c. July/Nov beans widen back out to 9 1/4c from 7c. March/May wheat inverse declines from 1 1/4c from 2 1/4c.

PALM OIL

Futures fell their hardest in three weeks hit by fears of higher production and slowing demand from India and China. Cash was off $20/mt finishing at $665.00/mt.

NEWS

Stocks and commodities are higher today, with the Dow up 60 pts and crude trading to $53.01/barrel. The US dollar trades up to 99.58. The US dollar remains firmer against a continuing weaker Brazilian Real.

CALLS

Calls are as follows:

beans: 5-7 lower

meal: .70-.90 lower

soyoil: 40-50 lower

corn: 1 lower

wheat: 3-4 lower

canola: 2.80-3.00 lower

Beans may have to trade lower to invite more buying interest, as PNW beans landed in China are reported to be $6/mt higher than Brazilian offers. Soyoil has challenges from higher soyoil stocks in the Jan NOPA report, (the highest in fact since April, 2018), along with sharply lower palm oil.

TECHNICALS

March Soyoil: Prices are lowering taking out and trading under the 200-day moving average of 3040c to trigger sell-stops and a poke at levels underneath 30c. Should the market take out double lows at 2980c, the next level of key support is located at 2950c, and think we probably go there on long liquidation.

first support: 2980c

lower support: 2950c

resistance: 3040c

possible range: 2980c-3040c

March Meal: Prices sideways off the contract low at $286.40. Look for a continuation of sideways trade from $286.40 to $295.00, and the market would need to trade back over $295.00 to head to $300.00. Would look for $289.00 to continue to offer good support, however, and if needing to price would do so.

first support: $289.00

resistance: $292.00

possible range: much the same

May Beans: Trading range is from $8.83 up to triple highs at $9.08. The market stalled at the triple highs and today begins on trendline support at $8.94. Would not rule out a test of $8.83 or perhaps lower as more crop supply hits the market.

trendline support: $8.94

resistance: $9.02

possible range: much the same

May Wheat: Overall trading range is from $5.40-$5.90, and the rally yesterday set the market up for prices to stay that way. A pullback to the 50-day moving average line of $5.53 would now be a good place to cover a short or try the long side with a tight stop below $5.40.

first support: $5.53

resistance: $5.63

possible range: much the same

May Corn: Prices are trading from $3.80-$3.93, and the market begins lower, unable to trade over three moving averages above it. Good support is still located at $3.75 should we go there on a break of size. For the day corn may hold its own against the other weaker markets.

first support: $3.82

resistance: $3.86

possible range; much the same

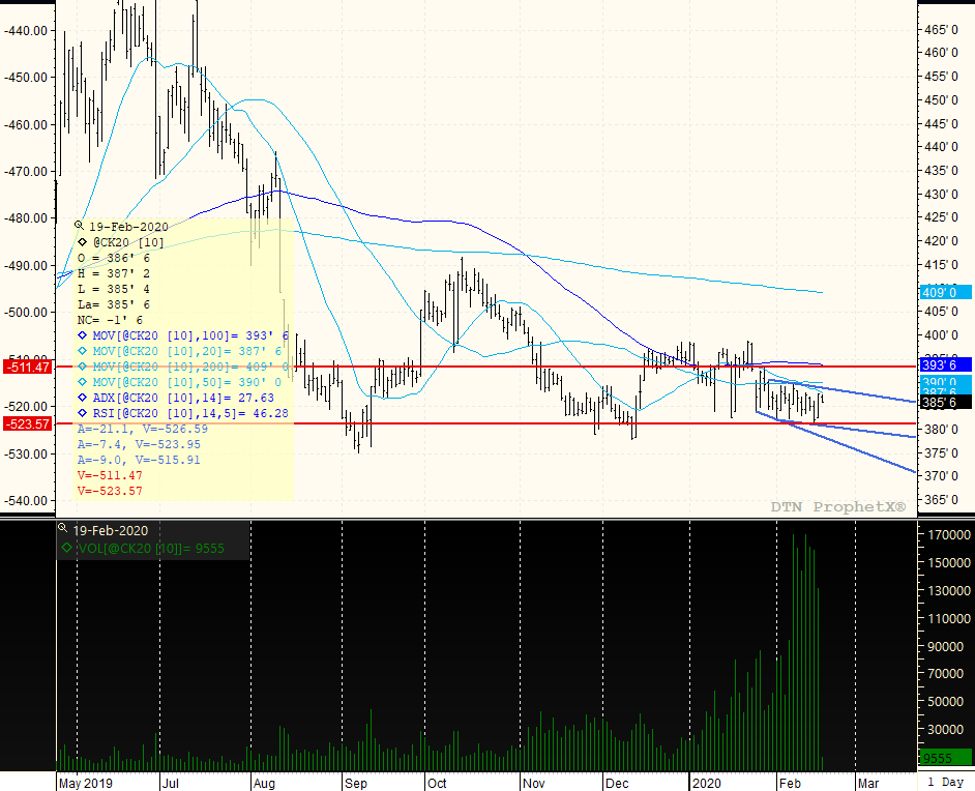

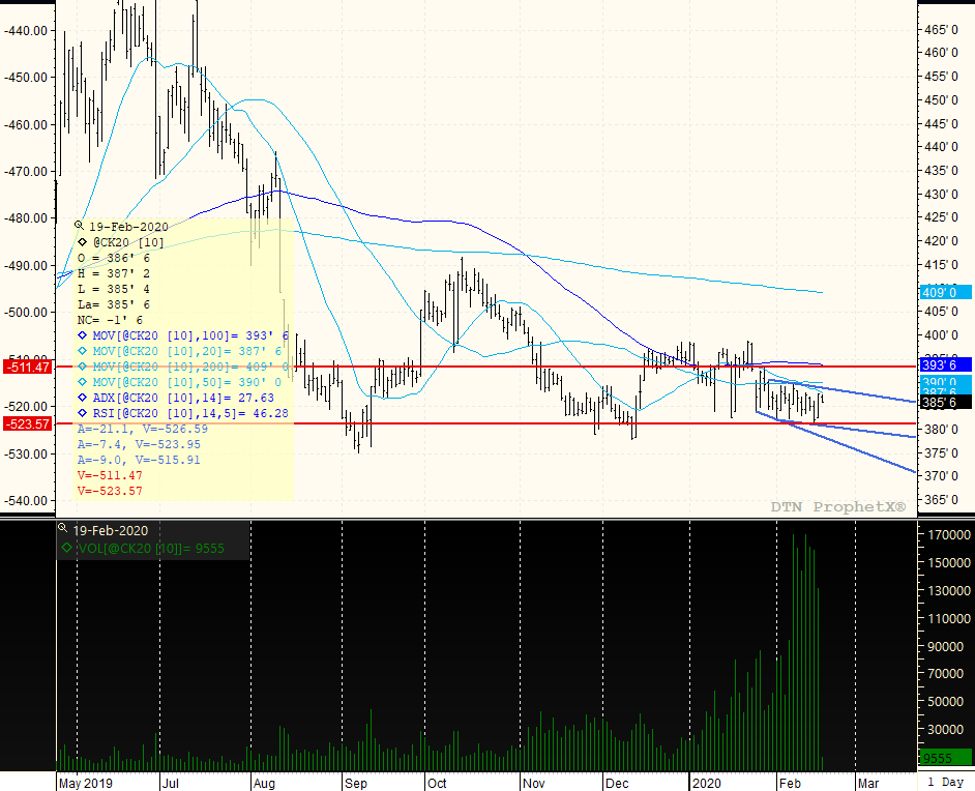

MAY CORN

Overall trading range is compact from $3.80 up to $3.92. Prices begin the day towards the top of the range with trendline resistance at $3.89 and support below at $3.81. The ADX trend is neutral at 27 as prices grind sideways. Have to play the trading range for now, but good US exports and a net fund short may drive this market up to the top of the range and keep it supported. On a heavy break, would cover a short or try the long side if the market can break to $3.75.

TAGS – Feed Grains, Soy & Oilseeds, Wheat, North America

The CBOT was mostly higher to end a mostly bearish week with wheat leading the way on several mildly bullish developments. Wheat futures saw price-supportive development in the IGC’s lower 2024/25 global ending stocks forecast, dryness in the U.S. Southern Plains, and smaller Russian 2024...

The CBOT was mostly higher to end a mostly bearish week with wheat leading the way on several mildly bullish developments. Wheat futures saw price-supportive development in the IGC’s lower 2024/25 global ending stocks forecast, dryness in the U.S. Southern Plains, and smaller Russian 2024...

USDA released the monthly Cattle on Feed report today. Total inventory, placements and marketings all came in lower than the pre-report estimates, though total inventory was at the same volume or higher than last year for the seventh consecutive month. Placements came in well below the average...

USDA released the monthly Cattle on Feed report today. Total inventory, placements and marketings all came in lower than the pre-report estimates, though total inventory was at the same volume or higher than last year for the seventh consecutive month. Placements came in well below the average...