GOOD MORNING,

The markets continue to put on good rallies. Features overnight include higher oilshare and soyoil strength, (on the back of strong palm prices), which helped beans to trade firm. There could be end-of-month short-covering in beans, as well as buying at perceived market lows into the Sep. Quarterly Stocks report which will be released at 11:00 central time. Corn tends to work higher seasonally at this time of the year. Wheat is higher due to rising global demand and active tenders for feed wheat. Algeria purchased close to 580 kmt of optional origin milling wheat in a tender yesterday. China will be on holiday next week, but rumors persist they have been shopping this week.

As a reminder, here are the advertised trade expectations for Sep. 1 stocks:

beans: 174 mln bu vs. 525 mln bu year ago

corn: 1.155 bln bu vs. 1.919 bln bu year ago

wheat: 1.852 bln bu vs. 2.158 bln bu year ago

This report can carry with it a lot of volatility. The report will define ending stocks for the 20/21 corn and bean marketing year that ended Aug. 31. The corn stocks average guess is 32 mln below where the USDA's World Board forecast ending stocks on Sep. 10, with bean stocks 1 mln above the Sep. carryout projections. The Sep 1 corn stocks have been outside the range of guesses for the last four years, while bean stocks have been correctly guessed in only two out of the last four years.

As prices rise, the bear is making an argument for further downside as demand has been tepid at best. The closed Gulf and a slow pace of Chinese buying is not friendly for the market. Nonetheless, beans saw a nice rally this week partly due to rising soyoil prices on the back of further inflation talk and higher crude. High freight rates and a higher US dollar are also price negative.

WEATHER

Rains will begin in the south and work its way into the central Midwest, which could slow harvest. Rains will move northward through Texas into southern, central areas next week bringing much needed moisture to winter wheat areas. 6/10 day calls for below normal precip. SA is trending drier, and could use more rainfall next month.

REPORTS

Export Sales:

beans: 21/22 net 1.09 mmt and 22/23 net 7,800 (vs. an expected .700-1.2 mmt)

meal: 20/21 net 66,800 and 21/22 net 162,900 mt (vs. an expected 50-250,000 mt)

soyoil: 20/21 net 6,000 tons and 21/22 net 22,400 (vs. an expected 0-20,000 mt)

corn: 21/22 net 370,000 mt (vs. an expected 400-900,000 mt)

wheat: 21/22 net 290,100 mt (vs. an expected 250-550,000 mt)

Wheat - Sales low end, and prices may have gotten too high. 21/22 sales down 19% from prev. wee k and 30% from 4-wk ave.

Corn - Sales primarily to Guatemala, with China seeing exports of 140,000 mt. Sales are poor.

Beans - Sales good primarily to China for 776,500 mt, including 204,000 mt switched from unknown.

Meal - sales up 48% and up 22% from prior 4-wk ave.

Soyoil - sales up 39% from prev. week to Costa Rica and the Dominican Republic

ANNOUNCEMENTS

China set its low tariff rate quota for wheat, corn, and rice imports in 2022 at the same volumes as the prev. yr. The Tariff Rate Quote (TRQ), for wheat imports in 2022 is 9.636 mmt, according to the National Development and Reform Commission.

Brazil is negotiating an increase of chicken export quotes to Britain, as reported by the head of the meat lobby ABPA.

CALLS

Calls are as follows:

beans: 1-2 higher

meal: 2.00-2.10 lower

soyoil: 40-60 higher

corn: 1/2-1 higher

wheat: 2-4 higher

TECH TALK

- Soy: November bean prices continue to congest in a sideways range, sitting just atop its 200-day moving average which crosses today at $12.78. This price action does not speak to a market that wants to move higher, although it continues to keep the average intact thus far. Trading range continues to be from $12.70-$13.00, and will see if the report drives prices through the moving average, in which case $12.50 is a target low, or back over $13.00 to target $13.10. ADX at 9 indicates that there is no trend, though seasonally beans do try to place a low this time of year heading into the SA planting season.

- December meal is likewise uncommitted to either side. Prices are caught between support at $335.00-$337.00 and resistance from $344.00-$345.00. The pattern has been to drift lower, stabilize, and then place another new low. Any trade under $335.00 targets $330.00.

- The December soyoil futures chart by contrast is constructive, as prices hold key support from 55c-56c, and now back towards tops of 58c. Continuing to recover and trending back towards the highs speaks to a market that could have the potential to target 60c, and think that is where we are headed based on this market's strong tech performance.

- Grains: Speaking of strong performances, corn has been in an uptrend lately with the high placed at the start of the week over $5.35 to $5.40. New highs are placed this AM at $5.41 1/4, as the market walks back to test support at $5.30-$5.33 successfully. Target high is $5.50/$5.52, but interim we could print $5.45 again. The direction has now turned sideways to higher, and buyers are now there on market pullbacks. December wheat is in a tight congestion phase from $7.00-$7.30, pivoting around the $7.15 level before it makes its next move. Major direction is sideways, but the chart has very strong support at the 100-day moving average at $7.00. Look for prices to perhaps test it, but hold the first time out.

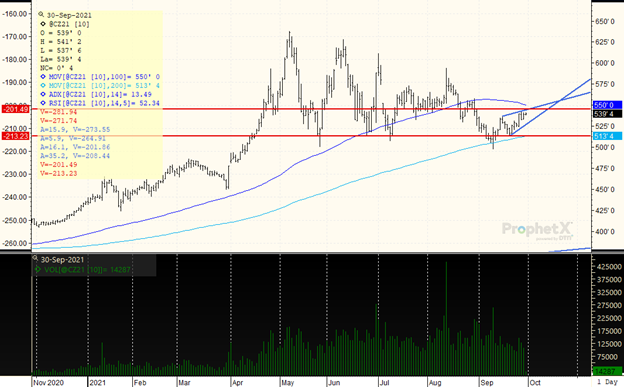

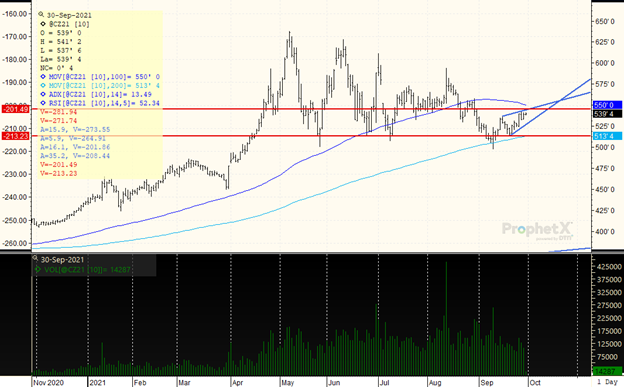

DECEMBER CORN

The trading range is from 5.15 to possible highs of $5.45/$5.50. The market broke out to the upside this week with trade over the previous range of $5.35/$5.38. The ascending triangle on the chart is a friendly formation, but tough resistance is noted at the top of the triangle which crosses from $5.44/$5.45. Target high is the 100-day moving average of $5.52. Since the market has remained well bid this week, even a break post report may find short-covering and more buying / bargain hunting.

TAGS – Feed Grains, North America

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...