GOOD MORNING,

Prices opened fairly close to home with wheat again the firm trade out, and all else mixed to slightly lower. During the PM session, prices firmed around the board led by soyoil. Egypt is in for wheat, and we will see what origin they purchase. Meal is trying to hang on to trading lows while soyoil continues to put in dynamic upside trade. Soyoil is firmer on the back of palm oil, which gapped to new ctr highs today. Other commodities also have a bid, with cotton closing limit and at 10-year highs. Crude oil remains on a path towards $80/barrel.

The October WASDE report is next week, and there are more guesses about yields crossing the headlines. IHS Markit forecasts corn production at 15.085 bln but with a 176.8 bpa yield. Bean production is forecast at 4.421 bln but with yield at 51.1 bpa. Discussions about acreage are going to increase over the next few months, with the high cost of fertilizer impacting December corn 2022 production. Extremely tight fertilizer supplies are a major concern for new crop corn, as is the higher fuel cost. As such, the Nov bean/corn 22 ratio is making new lows, suggesting to farmers that they plant corn.

Gulf loadings are getting back on track with elevators reportedly back to 80% or more capacity. Gulf barge unloadings are increasing which is weakening freight a bit.

WEATHER

--More rains make their way across the Midwest. The Midwest turns wetter for the central to western growing regions for the 6/10 day and 8-15 day maps which could slow harvest activity.

--Better rains are forecast for the center to south of Brazil where conditions remain good for planting. More showers are needed for Argentina.

ANNOUNCEMENTS

Russia's ag ministry lowered its overall grain export forecast from 51 mmt to between 48 and 45 mmt.

Ukraine's Ag Ministry forecast 2022 winter wheat plantings at 46% complete with 3.1 mln hectares sown so far.

Ukraine's Ag ministry forecast the 2021 grain harvest down to 80.25 mmt vs. 80.63 mmt prev. Wheat for 2021 was decreased to 31.55 mmt from 32 mmt, while left unchanged for corn at 37.1 mmt.

CALLS

Calls are as follows:

beans: 1-3 higher

meal: .80-1.00 higher

soyoil: 50-70 pts higher

corn: 1 1/2-3 higher

wheat: 4-6 higher

OUTSIDE MARKETS

In the red with stocks down 300 pts, with crude oil trading down to $77.77/barrel and the US dollar up to 94.44.

TECH TALK

- November beans placed an outside day closing higher which is constructive given the fall to new lows at $12.31. The trade could be a key reversal, but the volume on the up-turn was not as great as when the market fell to new lows last week. Key reversals need high turnover, so suspect the rally is trying to now establish a trading range. Trade over $12.65 would stabilize the chart, and would look to at least now test it. A successful test of $12.65 places the market into a sideways $12.30-$12.70 trading range, though the top of the market falls to $12.80 vs. $13.10 prev.

- The December meal chart remains bearish, with the chart attempting to trend higher from $320.00. This is a low for the move down, but must also prove it is a seasonal low. Would look for a grind into a $320.00 - $340.00 trading range in all likelihood.

- The December soyoil chart is constructive, finally trading well over the target high of 60c to reach a new high of 61.79c this AM. Would look for any pullback towards the 100-day moving average of 6020c as a buying opportunity for a market that has the potential to target 64c. Would look to target 62c close to the open given the extremely bullish close.

- December corn chart is in congestive mode, but trendline support now moves up to $5.34, which is the low of the PM session. The 100-day moving average crosses at $5.48, which is also trendline resistance. However, think we are headed in that direction as pullbacks are holding and the market has the ability to recover from losses. It is slowly building in a nice rally potential, and trade over $5.48 targets $5.55/$5.60.

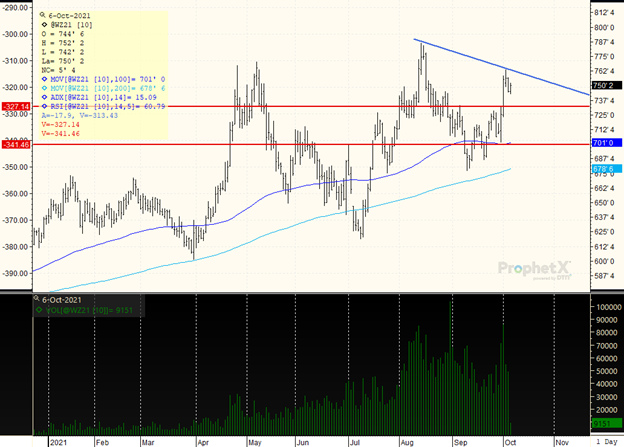

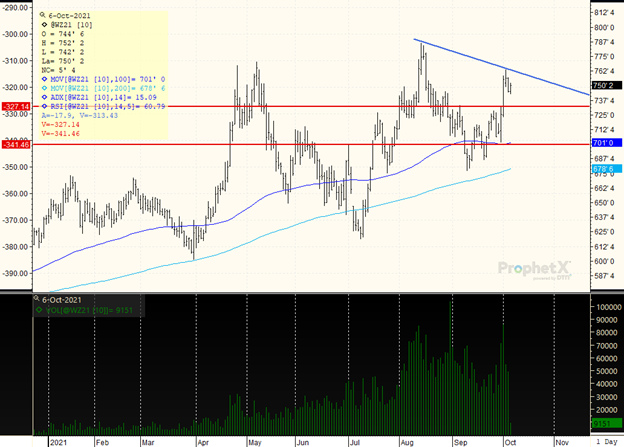

- The December wheat chart is also friendly as prices congest from $7.40 to recent highs at $7.63 1/2. Weak charts will quickly lose their rally and fall towards the lower end of the trading range, which is not the case here. That favors another test of the $7.58/$7.60 resistance level once more. If short, would probably opt to take something off the table.

DECEMBER WHEAT

The market is firmer post USDA report, placing a new high at $7.63 1/2 while rallying from $7.00, where the 100-day moving average is located. The pullback from the top has been fairly shallow suggesting the market could still be in the process of trading down to $7.25/$7.33 which would be the middle of the range. However, would note that it has taken a few days to pull back to $7.40, meaning that traders are now looking for pullbacks to own. If short, would therefore cover something in, as the market may test $7.33/$7.35 but find support there. Visual trendline resistance now crosses at $7.60 on a rally, but think we could go back there as stronger markets do not give much back, and this one in the big picture has not.

TAGS – Feed Grains, North America

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...