GOOD MORNING,

The markets have put in a good rally as we head into the Sep. 1 Quarterly Stocks report. Corn rallied on any number of items, including rumors of possible Chinese inquiries, higher energies, unwinding of previous buy wheat/sell corn trade, and better stochastics that expanded ranges to the upside. Seasonally, corn tends to trend upward at this point in time. Funds came out as buyers yesterday, and would look for pullbacks to likely see more of the same. Charts for corn posted another new high late this AM.

November beans never made it over the $13.00 benchmark, something noted by technicians. Harvest pressure, talk of decent yields rolling in, weaker spreads, and lack of exports weighed on prices. Overnight price action gave up more gains. Export inspections for beans were just 942 kmt vs. 5.0 mmt year ago. Recent business was finally verified yesterday, with more possibly coming.

The Sep. 1 Quarterly stocks report is out Thursday. As to current production guesses, the Corn and Bean Advisor lowered corn yield to 175.0 bpa with a neutral to lower bias, and production at 14.87 bln bu. Bean yield estimates were at 50.3 bpa, with production at 4.34 bln bu.

The focus today remains on the energy story, which is catapulting crude to new contract highs. Brent oil trades over $80/barrel as Goldman talks about greater demand on surging winter needs.

WEATHER

--US weather in the Midwest remains wide open for harvest. Expect progress to continue to be made through the balance of September into October.

--Weather in SA is neutral for now, though better rains will be needed next month.

REPORTS

Crop Progress

corn: 18% harvested, which was slightly behind expectations; dented 97% Mature: 74% Conditions: 59% good/excellent

beans: 16% harvested. Dropping leaves: 75% vs. 58% week ago. Conditions remain unchanged at 58% good/excellent.

winter wheat: 34% harvested, 9% emerged.

ANNOUNCEMENTS

Brazil's AgRural forecast bean planting in Brazil at 1.3% complete and corn 26% complete.

China's National Grain and Oils Information announced that expectations of a bumper harvest from new crop corn would likely see 21/22 corn prices falling. They said that wheat and rice stocks were plentiful, and that grain imports would remain at high levels in the new year.

Brazil's domestic flour millers threatened to stop buying wheat from Argentina if Brazil commercially approves GMO wheat imports from neighboring countries, said Rubens Brabosa, head of the Brazilian Wheat Industry Association.

CALLS

Calls are as follows:

beans: 3-4 lower

meal: .50-.80 lower

soyoil: 15-20 lower

corn: mixed

wheat: steady

OUTSIDE MARKETS

Stocks down 100 pts. with crude oil making new ctr highs again at $76.67/barrel. The US dollar is also firmer trading up to 93.66.

TECH TALK

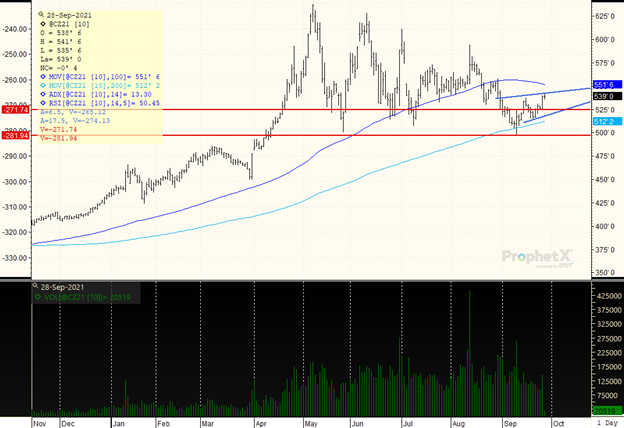

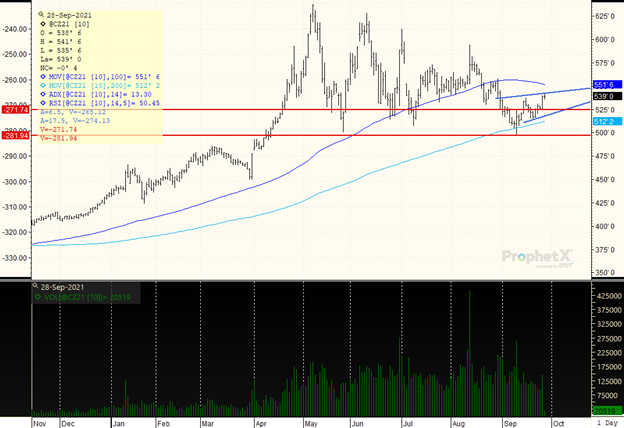

- December corn chart looks more friendly as the rally left behind lower congestion and expanded ranges to the upside. Seasonally this is a more friendly time-frame for corn. Look for pullbacks to likely see support, and end-users may move up pricing ideas. Lower support moves up to $5.25 and think we head towards $5.45/$5.50/bushel.

- Dec. wheat follows the adage that you can't keep a good market down. Prices break towards the middle of a $7.00-$7.35 trading range at $7.15 and hold, which could form a potential new support line. Would look for the wheat market to find a bid on pullbacks, and perhaps set new highs along with corn.

- November bean chart is still locked sideways but closer to the lower end of the range is $12.65/$12.70. Duly noted that prices could not stay under the break of $12.60, but also found a trade back towards the 200-day moving average of $12.78. It would now look negative were prices to go through a 200-day moving average, as that could send us towards the lows. The bean chart does appear more vulnerable to further downside but think we may stay poised above the 200-day.

- December meal trades again to the key major support level of $338.00, after spiking to a high trade of $344.00. The spike high only shows that this price action remains inherently weak, and that meal could once again test its lows of $335.00. The spike high now is another failed attempt for this market to rally, and a target low under $335.00 is $330.00.

- The December soyoil chart by contrast is extremely friendly, and the congestion trade back towards 5750c merely looks like a low that could hold for an eventual rally towards the 100-day moving average of 6015c. If short, would think about covering something in, and the low of 5750c is against a new trendline support level.

DECEMBER CORN

There are a few more positives to the corn chart now, as prices begin to trend slightly sideways/higher. The expansion was to the upside as prices rallied out of the previous $5.10-$5.35 trading range hitting $5.40. The 100-day moving average is now a likely target should prices rally further, which typically happens when a break-out occurs. Would note that yesterday's spike high was new buying on higher volume and open interests. Funds added about 10K new contracts, and therefore support now moves higher to the triple lows of $5.25. Due to the rally, would look for a possible $5.25-$5.52/$5.55 trading range to develop.

TAGS – Feed Grains, North America

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...