Forecasting developments in production agriculture

On behalf of a private U.S. agricultural technology provider, WPI’s team generated an econometric model to forecast the movement of concentrated corn production north and west from the traditional U.S. Corn Belt. WPI’s model has subsequently provided quantitative support to a multi-million-dollar investment into short-season corn variety development. WPI’s methodology included a series of interviews with regional grain elevators and seed consultants. Emphasizing outreach and communication with stakeholders who possess intimate sectoral knowledge – on-the-ground insights – is a regular component of WPI’s methodologies, made possible by WPI’s ever-growing network of industry contacts.

Wheat remains the star of the ag commodity space this week with the rally continuing on challenging weather prospects for the U.S. HRW region, Europe, and the Black Sea. Until a few weeks ago, there were few doubts about the 2024 crop being able to supply the expected demand, but now reduced yi...

Wheat remains the star of the ag commodity space this week with the rally continuing on challenging weather prospects for the U.S. HRW region, Europe, and the Black Sea. Until a few weeks ago, there were few doubts about the 2024 crop being able to supply the expected demand, but now reduced yi...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

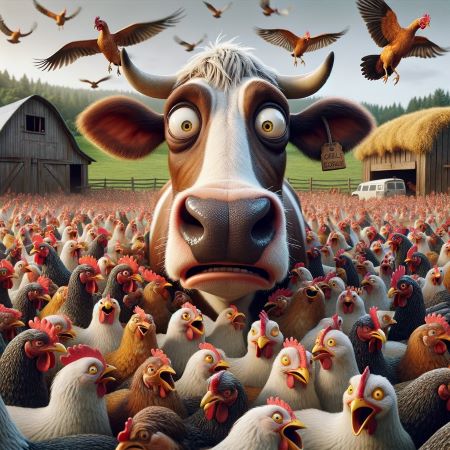

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...