Weighing in on strategic realignment

WPI’s team was retained by the governing board of a U.S. industry organization to review a decision, reached by vote, to invest significant assets into the development and management of an export trading company. WPI’s team conducted a formal review of this decision and concluded that the current level of market saturation would limit the benefits of the investment. Based on WPI’s analysis and recommended actions, the board subsequently reversed its decision and undertook a strategic planning effort to identify more impactful investments. On behalf of numerous clients, WPI has not only assisted in identifying strategic paths but also advised their implementation.

Wheat remains the star of the ag commodity space this week with the rally continuing on challenging weather prospects for the U.S. HRW region, Europe, and the Black Sea. Until a few weeks ago, there were few doubts about the 2024 crop being able to supply the expected demand, but now reduced yi...

Wheat remains the star of the ag commodity space this week with the rally continuing on challenging weather prospects for the U.S. HRW region, Europe, and the Black Sea. Until a few weeks ago, there were few doubts about the 2024 crop being able to supply the expected demand, but now reduced yi...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

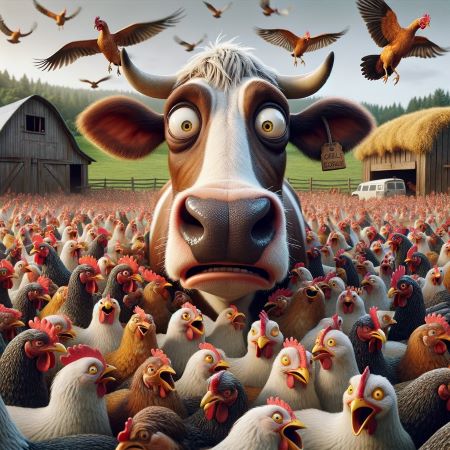

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...