Communicating importance of value-added products

Facing increasing pressure to quantify the value of export promotion efforts to investors, a U.S. industry organization retained WPI to develop a quantitative model that better communicated the importance of exports. The resulting model concluded that value-added meat exports contributed $0.45 cents per bushel to the price of corn, increasing support for that sector’s financial support of WPI’s client. In addition to serving the red meat industry with this type of analysis, WPI has generated similar deliverables for the U.S. soybean and poultry/egg industries.

Large supplies and a strong dollar took their toll this week on corn and soybeans, but they still managed to outperform. Weather worries pushed wheat higher for a seventh straight session, and pork finally took a fall. There was high volume trading in corn today but without any strong fee...

Large supplies and a strong dollar took their toll this week on corn and soybeans, but they still managed to outperform. Weather worries pushed wheat higher for a seventh straight session, and pork finally took a fall. There was high volume trading in corn today but without any strong fee...

The Market Brazil has been winning the soybean export war, and imported biodiesel feedstock threatens domestic crush margins, but Chicago trading this week appeared to shake off such concerns. July soybeans traded lower for the past three trading sessions but larger gains achieved at the beginn...

The Market Brazil has been winning the soybean export war, and imported biodiesel feedstock threatens domestic crush margins, but Chicago trading this week appeared to shake off such concerns. July soybeans traded lower for the past three trading sessions but larger gains achieved at the beginn...

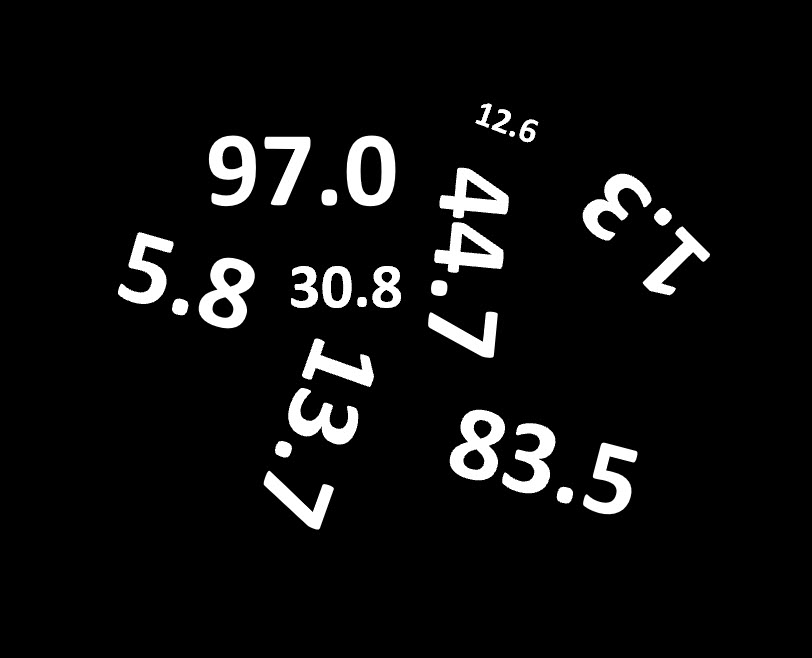

The Q1 2024 GDP was 1.6 percent, well below the pre-report consensus expectation of 2.4 percent, and down from 3.1 percent in Q1 2023 and 3.4 percent in Q4 2023. That rate was the slowest in almost two years, dating back to Q2 2022. Recall that in the 2 February Ag Perspectives report on...

The Q1 2024 GDP was 1.6 percent, well below the pre-report consensus expectation of 2.4 percent, and down from 3.1 percent in Q1 2023 and 3.4 percent in Q4 2023. That rate was the slowest in almost two years, dating back to Q2 2022. Recall that in the 2 February Ag Perspectives report on...