Accountability and a comprehensive approach to export programming

WPI’s team helped construct a strategic approach to develop, implement, and track promotional activities in 8 key regions across the globe for an agricultural export association. With continued progress measurement and strategic advisory services from WPI, the association has seen its ROI from investments in promotional programming increase by 44 percent over the past 5 years. Not only does this type of holistic approach to organizational strategy provide measurable results to track and analyze, it fosters top-down and bottom-up organizational accountability.

The Market Brazil has been winning the soybean export war, and imported biodiesel feedstock threatens domestic crush margins, but Chicago trading this week appeared to shake off such concerns. July soybeans traded lower for the past three trading sessions but larger gains achieved at the beginn...

The Market Brazil has been winning the soybean export war, and imported biodiesel feedstock threatens domestic crush margins, but Chicago trading this week appeared to shake off such concerns. July soybeans traded lower for the past three trading sessions but larger gains achieved at the beginn...

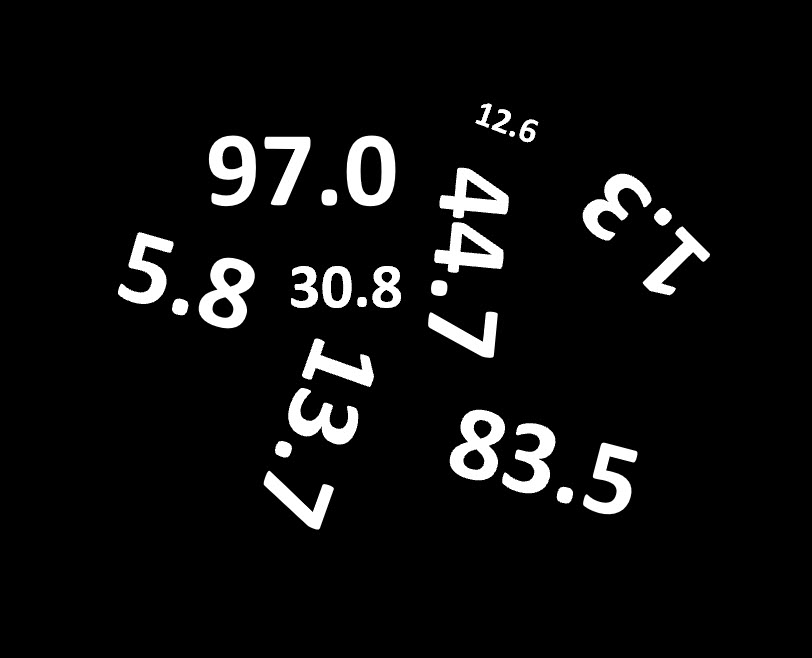

The Q1 2024 GDP was 1.6 percent, well below the pre-report consensus expectation of 2.4 percent, and down from 3.1 percent in Q1 2023 and 3.4 percent in Q4 2023. That rate was the slowest in almost two years, dating back to Q2 2022. Recall that in the 2 February Ag Perspectives report on...

The Q1 2024 GDP was 1.6 percent, well below the pre-report consensus expectation of 2.4 percent, and down from 3.1 percent in Q1 2023 and 3.4 percent in Q4 2023. That rate was the slowest in almost two years, dating back to Q2 2022. Recall that in the 2 February Ag Perspectives report on...

As WPI readers likely well know by now, U.S. gross domestic product (GDP) grew at an inflation- and seasonally-adjusted 1.6 percent rate in Q1 2024, which missed economist’s 2.4 percent expectations. The data sent shockwaves through U.S. financial markets with U.S. stocks and bonds openin...

As WPI readers likely well know by now, U.S. gross domestic product (GDP) grew at an inflation- and seasonally-adjusted 1.6 percent rate in Q1 2024, which missed economist’s 2.4 percent expectations. The data sent shockwaves through U.S. financial markets with U.S. stocks and bonds openin...