Forecasting developments in production agriculture

On behalf of a private U.S. agricultural technology provider, WPI’s team generated an econometric model to forecast the movement of concentrated corn production north and west from the traditional U.S. Corn Belt. WPI’s model has subsequently provided quantitative support to a multi-million-dollar investment into short-season corn variety development. WPI’s methodology included a series of interviews with regional grain elevators and seed consultants. Emphasizing outreach and communication with stakeholders who possess intimate sectoral knowledge – on-the-ground insights – is a regular component of WPI’s methodologies, made possible by WPI’s ever-growing network of industry contacts.

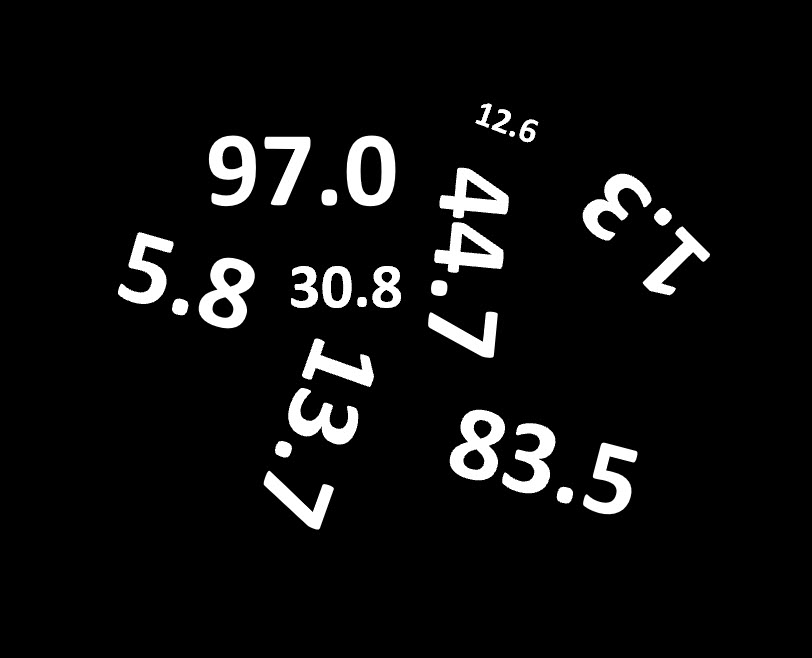

The Q1 2024 GDP was 1.6 percent, well below the pre-report consensus expectation of 2.4 percent, and down from 3.1 percent in Q1 2023 and 3.4 percent in Q4 2023. That rate was the slowest in almost two years, dating back to Q2 2022. Recall that in the 2 February Ag Perspectives report on...

The Q1 2024 GDP was 1.6 percent, well below the pre-report consensus expectation of 2.4 percent, and down from 3.1 percent in Q1 2023 and 3.4 percent in Q4 2023. That rate was the slowest in almost two years, dating back to Q2 2022. Recall that in the 2 February Ag Perspectives report on...

As WPI readers likely well know by now, U.S. gross domestic product (GDP) grew at an inflation- and seasonally-adjusted 1.6 percent rate in Q1 2024, which missed economist’s 2.4 percent expectations. The data sent shockwaves through U.S. financial markets with U.S. stocks and bonds openin...

As WPI readers likely well know by now, U.S. gross domestic product (GDP) grew at an inflation- and seasonally-adjusted 1.6 percent rate in Q1 2024, which missed economist’s 2.4 percent expectations. The data sent shockwaves through U.S. financial markets with U.S. stocks and bonds openin...