SPREADS

Crush margins continue to firm with March trading to 1.02c/bu. Oilshare trades back up to 34.0%. Jan/March beans trade to ctr lows at 14 1/4c. Dec/March corn trades from 10 1/4c to 10 1/2c, while Dec 19/Dec 20 trades from 25 1/2c to 26c. Dec wheat/corn trades from 1.51c to 1.40 3/4c. Dec/March meal narrows into $4.50 from $4.80.

PALM OIL

Feb crude oil closes up 76 ringgits, boosting soyoil futures today. Talk that Nov production could be down as much as 10-13% sparked the rally.

NEWS

Stocks are 55 pts higher with crude oil at $58.51/barrel, and the US dollar trading at 98.06.

CALLS

Calls today are as follows:

beans: 1/2-1 lower

meal: .80-1.00 lower

soyoil: 25-30 higher

corn: 1/2 -1 lower

wheat: 1 1/2-2 higher

canola: .80-1.00 higher

TECHNICALS

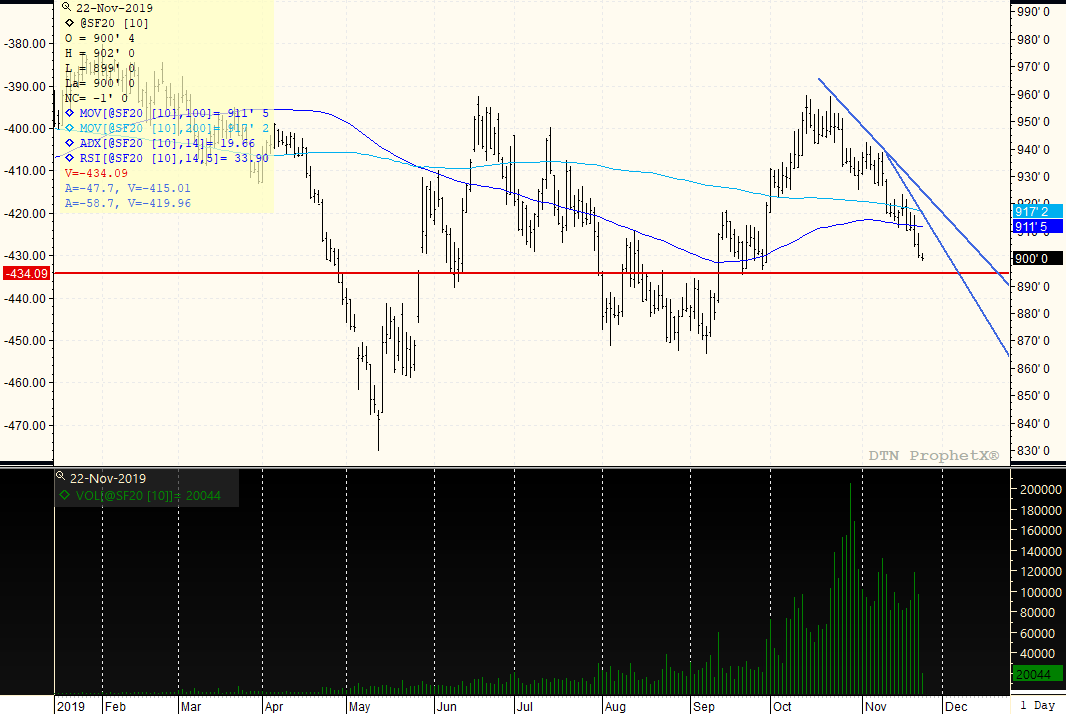

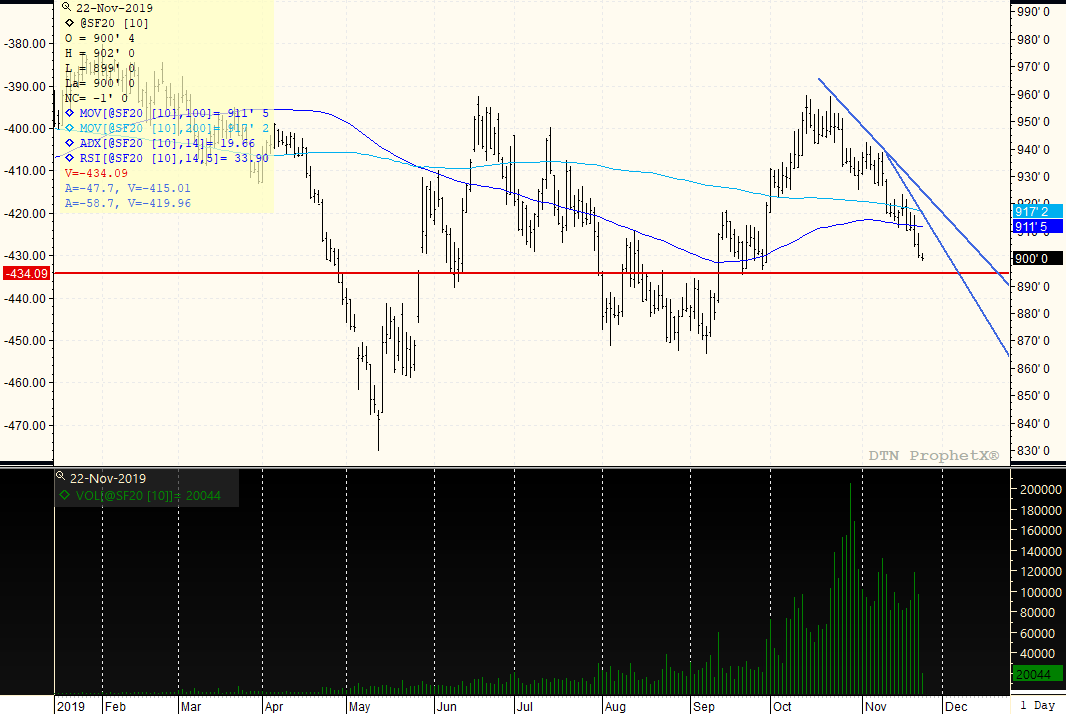

Jan Beans: Prices continue to move downward, piercing the $9.00 level for a $8.99 trading range low. New lows beget new lows and with the move down resistance also moves lower to $9.10. The market continues to struggle to find support, but lows at $8.98 offer a first stab at it, and then $8.94, should we go there.

first support: $8.98

resistance: $9.05/$9.08

possible range: $8.98-$9.08 or lower

Jan Meal: Prices continue to edge lower, and trendline support for the day is located at $301.50. Would look to go there and test it, but crossing to the downside of it creates a further push below $300.00. If needing to price something, this is a good place to start, and if we break $300.00, then support does not come into play until we reach $295.00.

first support: $301.50

resistance: $303.50

possible range: much the same or lower

Jan Soyoil: Charts are looking toppy, with the possible formation of a head and shoulders top. Neckline support is at 3050c, and if the market trades back over 3180c then look for a large 3050c-32c trade to continue. Fundamentals still suggest that pullbacks in this market should be purchased, but with funds being so long, any confirmation of a top would be problematic. For the day, considering continued strength would look to test the upper portion of the "right shoulder" with tops at 3150c.

first support: 3090c

resistance: 3150c

possible range: much the same

March Corn: The trend has been lower but the market has once again turned sideways with price congestion from $3.77-$3.80. Three prior lows have now been placed at $3.76 3/4-$3.77, but the pattern here has been to attempt to turn sideways, only to break lower. The downtrend channel remains intact, with trendline support crossing today at $3.75/$3.76, should we go there. The market needs a rally over $3.81 in order to kick off a larger rally towards top of the trading range at $3.86. On a lower start, we could likely test $3.76 one more time.

trendline support: $3.75 1/2-$3.76

trendline resistance: $3.79 1/2-$3.80

possible range: much the same

March Wheat: Prices remain sideways as opposed to lower, with best resistance overhead at $5.23 and best support at multiple lows at $5.11. The market remains well bid, and the bounce off $5.11 was constructive. The 200-day moving average crosses at $5.09, so it is not surprising to see prices bouncing off the lows of the PM session. Look to possibly test $5.18 once again, and merge into a consolidation trade.

first support: $5.09/$5.11

resistance: $5.18

possible range: much the same

JANUARY BEANS

Major trend is lower as the market continues to build on weakness, forming new lines of good resistance on the way down. However, we have arrived close to key support at $8.98, which typically holds the first time around. As such, and since this is Friday, would not be surprised to see both sides trade and get a bounce as well from these levels. Should we continue to trend lower after the open, the target low for now before a broader recovery is $8.94. New lows beget new lows, and for now the chart has not yet stabilized, though think at $8.95 it finds better support for a return to a $8.95-$9.15/$9.20 trading range.

TAGS – Feed Grains, Soy & Oilseeds, Wheat, North America

Wheat remains the star of the ag commodity space this week with the rally continuing on challenging weather prospects for the U.S. HRW region, Europe, and the Black Sea. Until a few weeks ago, there were few doubts about the 2024 crop being able to supply the expected demand, but now reduced yi...

Wheat remains the star of the ag commodity space this week with the rally continuing on challenging weather prospects for the U.S. HRW region, Europe, and the Black Sea. Until a few weeks ago, there were few doubts about the 2024 crop being able to supply the expected demand, but now reduced yi...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...