SPREADS

May crush trades to 71c/bu while oilshare trades strongly back over 37.0% to close at 37.10%. July/Nov bean inverse trades from 1.73 1/4c down to 1.67 1/4c, while May/July inverts to 14c from 12 3/4c. July/Dec meal inverse trades from $40.50 up to $41.60. July/Dec corn inverse is weaker, trading down to 62 3/4c from 67 1/4c. July wheat/corn trades from 1.15 1/2c to 1.18 1/4c.

PALM OIL

May up 50 ringgits. Prices were higher in early Asian trading on oil's higher close in Chicago and positive trade on the Dalian Exchange. Weak exports and rising production could curtail a higher trending market. AmSpec released Feb. 2021 exports estimates at 1.000 mmt, down 8.2% from Jan.

NEWS

Macros are risk on with more stimulus coming along with a new vaccine that could continue to curtail Covid-19 infections. Stocks are up over 300 pts as the new month begins, with crude trading to $62.92/barrel and the US dollar trading to new highs at 91.12.

CALLS

Calls today are as follows:

beans: 9-11 higher

meal: 3.50-4.00 higher

soyoil: 20-25 higher

corn: steady

wheat: 2 -4 higher

canola: 3.00-3.50 higher

BUSINESS

No business reported

TECHNICALS

May Beans: Prices left a gap overnight which is still open this morning as we start from $14.08 to $14.11. Prices closed strongly, which increases the chance that the gap will remain unfilled with prices heading back towards $14.25. The fact that we have a gap is positive, and would look for gap closure to now offer support should we fill it. The chart is reinforcing support at the bottom of a range from $13.80 to $14.50, using $14.20-$14.25 as a pivot point.

first support: $14.05/$14.08

resistance: $14.23 to $14.25

possible range: $14.12-$14.25

May Meal: Prices broke down to $415.00 last week but quickly rejected those lows for higher trade. Prices are back in the $420.00-$440.00 trading range once more, with a good close. Look for the increased chance of testing $430.00 to $435.00 on price recovery.

first support: $424.00

resistance: $428.00/$429.00

possible range: much the same

May Soyoil: Overall trading range is from 4850c to current contract highs of 5095c. Double highs are now from 5060c to 5095c. The major direction remains higher and the trend is very strong. Would look for any break to 4950c/4980c to be a buying opportunity, with the top of the market not yet defined.

first support: 4980c

resistance: 5050c

possible range: much the same or higher

May Corn: Major support is located at $5.40 and resistance from $5.55 to $5.58. Trendline resistance is located at $5.58 should we go there. The market is showing some weakness with a negative close. Would look for a break lower to remain well supported for a $5.40 - $5.70 trading range.

first support: $5.42/$5.43

resistance: $5.52/$5.53

possible range: much the same

May Wheat: The overall trading range is from $6.50 - $6.93, current contract highs. For the day, trendline support is located at $6.60 and if we go there may hold for a continued retracement of the $6.60-$6.75 trading range. If wanting to be short, prices would have to open and quickly break $6.60, which would still present good support layered in at $6.53. If short, would scale down cover from $6.60 to $6.50, and hold the rest in case prices can settle under $6.50.

trendline support: $6.58/$6.60

resistance: $6.70

possible range: much the same

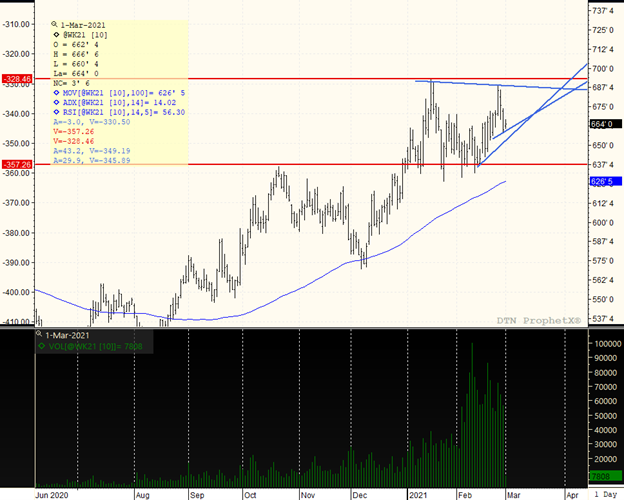

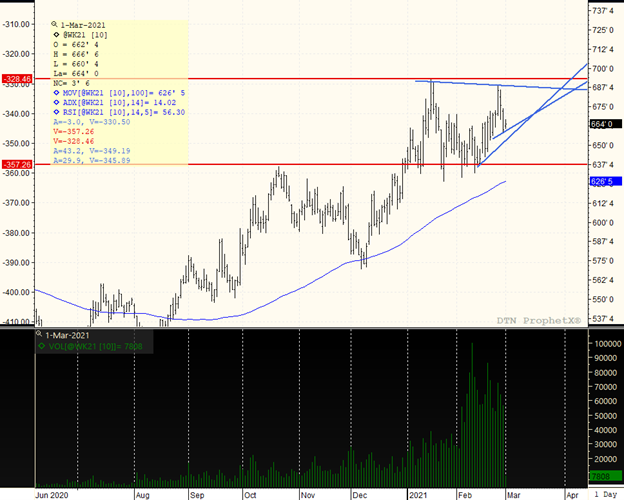

MAY WHEAT

The market contract high is $6.93 and the market is operating in the upper half of the overall trading range. ON the break the $6.50 level held, though the trend is weak at 14, making this market a good one to straddle or strangle. For now, it appears that the break to $6.60 could be low enough as prices rally back again. Could straddle or strangle a range from $6.30-$6.90, but the chart continues to generate better lines of support at the bottom, while resistance on a rally remains light overhead. Look to stay within the triangle formation, with prices perhaps heading higher towards $6.93 once again.

TAGS – Feed Grains, Soy & Oilseeds, Wheat, North America

The bearishness continues as South America crops loom and Northern Hemisphere weather is stable. The impending flood of Argentine soymeal and soyoil onto the market sent the May soyoil contract to a new low. There was nothing in today’s weekly USDA Export Sales report to alter the...

The bearishness continues as South America crops loom and Northern Hemisphere weather is stable. The impending flood of Argentine soymeal and soyoil onto the market sent the May soyoil contract to a new low. There was nothing in today’s weekly USDA Export Sales report to alter the...

Transatlantic GI’ing Consumers Politicians on both sides of the Atlantic protest big business and their sacrilegious capitalism. Yet sometimes it is government screwing the consumer to boost private profits. Parmigiano Reggiano was a prized and premium priced cheese before obtaining the E...

Transatlantic GI’ing Consumers Politicians on both sides of the Atlantic protest big business and their sacrilegious capitalism. Yet sometimes it is government screwing the consumer to boost private profits. Parmigiano Reggiano was a prized and premium priced cheese before obtaining the E...