SPREADS

September KC/Chicago spreads moved to new contract lows yesterday. KC wheat/corn spreads moved back to levels conducive to putting HRW back into feed. October crush firms to 1.07c/bu while oilshare firms to new highs at 33 percent. Dec/March corn trades from 10c to 10 1/4c while Dec 19/20 trades from a 3c to 5 1/2c inverse. Sep/Dec meal trades from $5.10 to $5.30. Dec wheat/corn trades from 84 3/4c to 80c.

PALM OIL

Closed up 41 ringgits for October.

NEWS

Stocks are lower this morning off 80 pts with crude oil firmer at $53.75/barrel and the US dollar weaker at 97.49. US June PPI final demand was left unchanged at +0.1 percent.

CALLS

Calls are higher across the board with good technical performances, and a drought monitor that is starting to get worse suggesting, we need to see good rainfall soon:

beans: 4-6 higher

meal: 1.00-1.40 higher

soyoil: 40 higher

corn: 2 1/2 higher

wheat: 5 higher

TECHNICALS

Dec Corn: Major direction is sideways/higher, and we held key support at $4.09 to trade back over $4.20. The close was extremely constructive and suggests that we trend towards $4.205 with a stop at $4.23 where the next level of resistance is located. Think that the change of direction finds pullbacks supported. Best location of support now moves up to $4.16, should we go there.

first support: $4.16

resistance: $4.23

possible range: much the same or higher

Sep Wheat: The market formed a small uptrend channel with a base from $4.75 - $4.95. The close was into key resistance at $5.00, which may trigger some buy-stops at the open and take us to $5.08. Best level of resistance that would turn back a rally is $5.15, and it is close to the top end of the trading range at $5.25. A pullback towards $4.95 will offer up support if we go there given the market correction to the upside.

first support: $4.98

resistance: $5.05/$5.08

possible range: much the same or higher

Nov Beans: Major direction is sideways/higher, and the market closed right into key resistance at $8.90, which has been both the top and the bottom of recent trading ranges. Therefore, a trade over $8.90 will find more short-covering and test $9.00/$9.05. Given the good close, think we probably print $8.90 at the open and target values above.

first support: $8.82/$8.85

resistance: $8.90/$8.95

possible range: much the same or lower

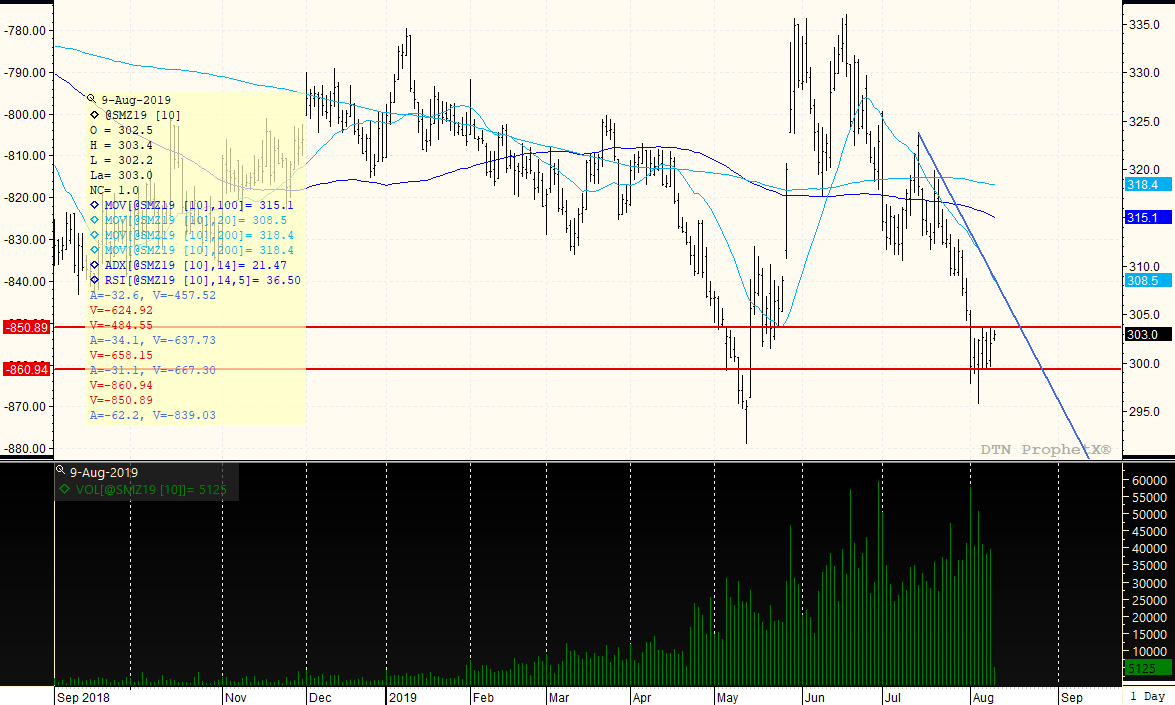

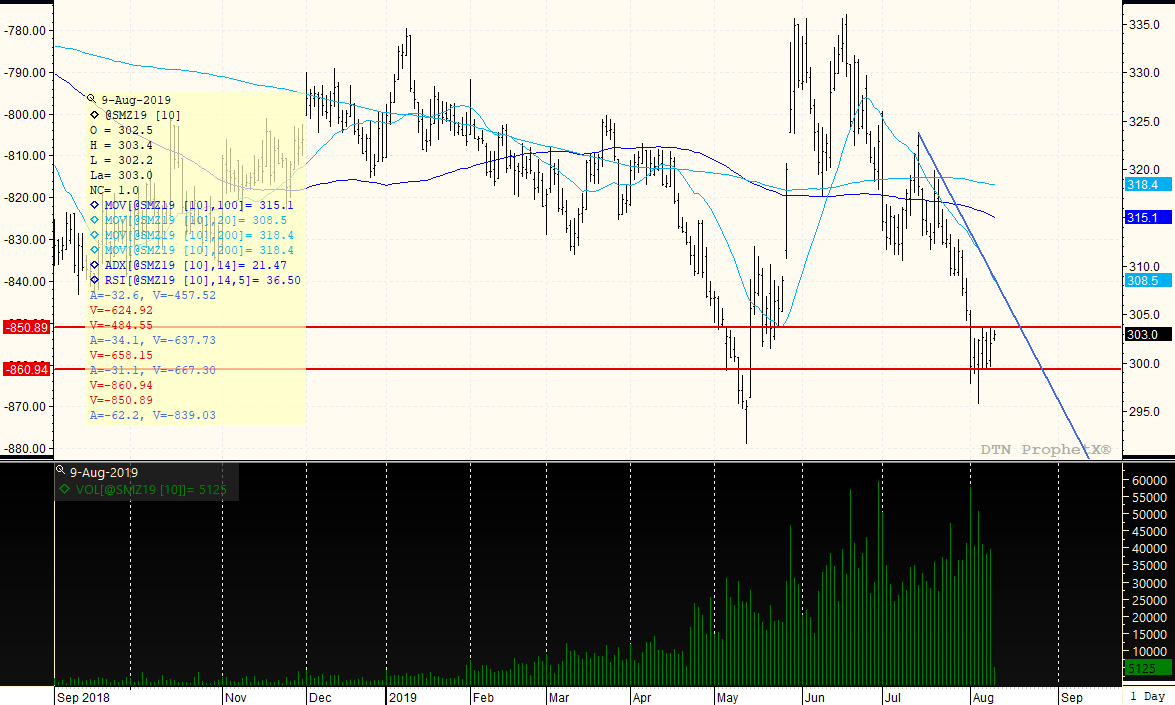

Dec Meal: Chart is sideways with major lows crossing at $300.00. Technically, we are therefore forming a base, and if we see some unwinding of the recent buy soyoil/sell meal trade then this chart can make an upward adjustment heading into Monday to establish a $300.00 - $310.00 trading range. Would look for that possibility rather than another large break. Any trade over $305.00 brings in more buying activity and a probable trade to $308.00.

first support: $302.00

resistance: $305.00

possible range: much the same or higher

Dec Soyoil: The market broke out to the upside when it traded over 2930c. The new high is 30c. On a setback, would look for 2930-2950c to offer up support. The target high on any settlement over 30c would be 3020c, then 3050c at the top. Soyoil has had a tough go on rallies, so would probably be lightening up on overall length on rallies back towards 30c until we confirm we can close over.

first support: 2930c-2950c

resistance: 30c-3020c

possible range; much the same or lower

DECEMBER MEAL

Price action is congested at the bottom of the chart, but is building in a base of trade from $300.00-$305.00. Given the extent of the break, we could see trade back over $305.00, which clearly opens the door to trade up to $308.00 and then $310.00. Think this is probably where we are headed - for a $295.00-$310.00 trading range on a correction upward.

TAGS – Farm Inputs, Macroeconomics, Wheat, North America

Wheat remains the star of the ag commodity space this week with the rally continuing on challenging weather prospects for the U.S. HRW region, Europe, and the Black Sea. Until a few weeks ago, there were few doubts about the 2024 crop being able to supply the expected demand, but now reduced yi...

Wheat remains the star of the ag commodity space this week with the rally continuing on challenging weather prospects for the U.S. HRW region, Europe, and the Black Sea. Until a few weeks ago, there were few doubts about the 2024 crop being able to supply the expected demand, but now reduced yi...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

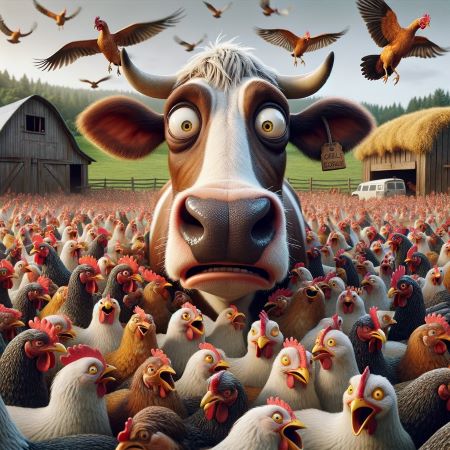

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...