SPREADS

October crush trades at 1.09c/bu while oilshare is slightly weaker at 2.78 percent. Dec/March corn trades from 12 1/4c to 12 1/2c, while Dec 19/20 corn narrows into 27 1/4c from 30 1/2c, and values that were at 34c a week ago. Nov/Jan beans trades from 13 3/4c out to 14c carry. Dec wheat/corn trades from 96 1/4c to 95 1/4c. Sep/Dec wheat trades from 6 1/4c out to 7 1/4c, while Dec/March trades from 7c to 7 1/4c.

PALM OIL

October closed up 19 ringgits. Indonesian palm producers are concerned about drought impacting their crop. Drought has hit a large part of the islands as a mild El Nino affects the weather pattern. Palm prices are up 10 percent since July.

NEWS

Stocks were higher overnight but have traded both sides of even. Crude oil weakens down to $55.87/barrel with the US dollar higher at 98.42.

CALLS

Calls today are as follows:

beans: 4-6 higher

meal: 1.60-1.90 higher

soyoil: 15-20 higher

corn: 4 1/2-5 higher

wheat: 2 -2 1/2 higher

canola: 2.20-2.40 higher

TECHNICALS

November Beans: Overall trading range is $8.60 - $8.95, using $8.75 as a pivot point. For the day, minor trendline resistance crosses at the session high of the overnight back at $8.75/$8.76, so crossing to the upside of this level will trigger more fund short-covering and return to the upper portion of the trading range. Overall, traders are still looking for good rallies to sell.

first support: $8.70

resistance: $8.75/$8.78

possible range: much the same or higher

Dec Meal: Good support is located at $295.00/$296.00 with minor resistance at $300.00. We might stay within this congestion zone, however crossing to the upside of $300.00 is going to give the market a further lift towards the higher end of the trading range at $305.00. If short, would be covering or pricing from $295.00-$300.00 as it has held as long term support with only one trade to the downside since May.

first support: $296.50/$297.00

resistance: $300.00/$300.50

possible range; much the same or higher

December Soyoil: Prices appear to have set a temporary top from 2945c-3025c, with sell-stops under 29c taking the market back to important support, which is closer to 2850c/2860c. Would look for soyoil to probably be the weaker chart today, and even the first to go negative if prices break. Given that the 200-day moving average returns to 2945c, would look for another test of 29c again.

first support: 2890c

resistance: 2945c

possible range: much the same

December Corn: Sporting a bit of a "v" recovery off the low of $3.69, which typically sees more upside follow-through. The market is beginning a consolidation process that may eventually test the open gap from $3.88-$3.92. Trendline support on another break crosses near the overall low at $3.69 at $3.67, with $3.50 (should we get there) becoming a long-term value level. For the day would look to see if an opening break could hold back towards $3.74 for further trading range activity.

key support: $3.70/$3.73

resistance: $3.80/$3.81

possible range: much the same

Dec Wheat: Overall trading range appears to be from $4.70-$4.85. Ranges have been extremely compact from $4.70-$4.80. In that the market has refused to break much, we may need to see a corrective price rally upward that would get this market a bit unstuck. Wheat may be a follower of corn today.

first support: $4.71

resistance: $4.75/$4.77

possible range: much the same or higher

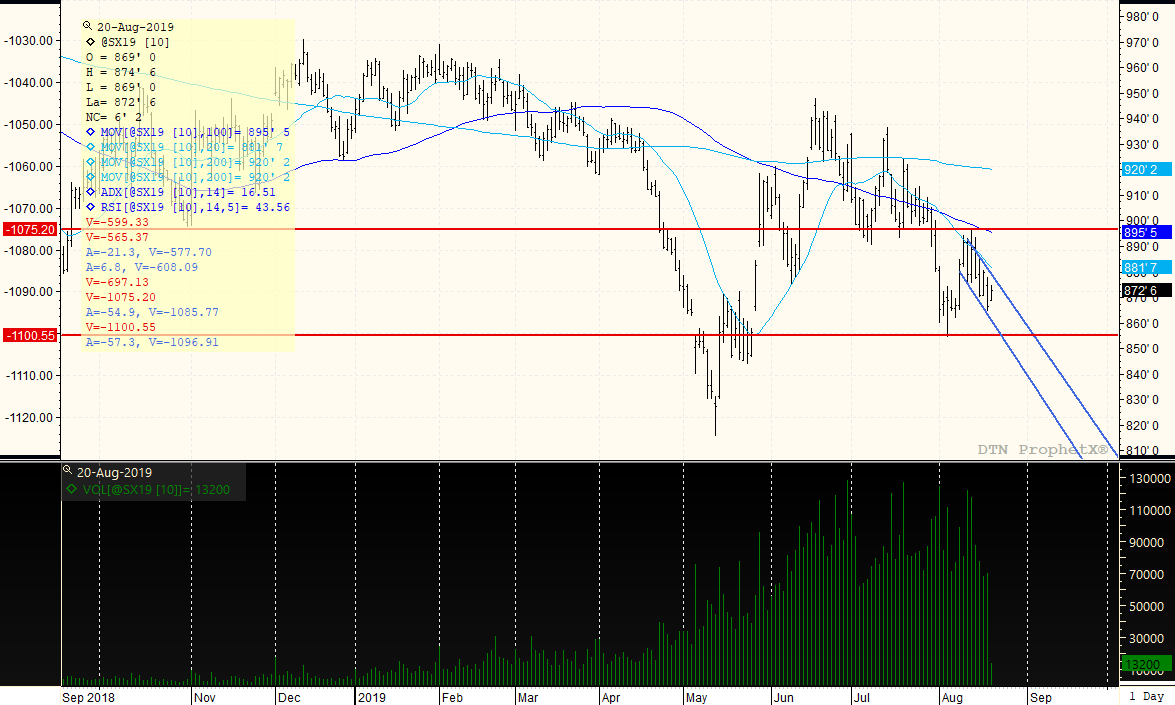

NOVEMBER BEANS

The trading range from $8.60 to $8.95 is outlined in red, and could straddle/strangle the market with a lower outcome as seasonally this is the time of the year when it's hard to keep bean prices higher. The contract low is $8.15 1/2. The dominant formation guiding price action now is the downtrend channel, so crossing it to the upside will indicate a short-covering rally back towards the top of the trading range again. For the day, that pivot point returns to $8.75. On a higher start, look to probably test it, and if short would cover or try the long side if we head to the upside of the downtrend channel from $8.75/$8.77.

TAGS – Feed Grains, Soy & Oilseeds, Wheat, North America

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

Most Apparent Solution The EU’s organic sector wants the bloc’s officials to take more action to ensure they achieve the target of 25 percent of agricultural output being organic by 2030. Specifically, they want a campaign to increase consumer demand for organic food so that organic...

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...

Yesterday, the Animal and Plant Health Inspection Service (APHIS) issued a federal order requiring testing and reporting of highly pathogenic avian influenza (HPAI) for the interstate movement of lactating dairy cattle. Specific guidance will be issued at some point today, and the order will go...

Corn, soybeans and soyoil all closed lower after trading up the previous three sessions. July soymeal made it a fourth trading session higher, and wheat remains on a tear with a fifth trading session closing higher. The mood around wheat sees supply concerns developing in North America and in t...

Corn, soybeans and soyoil all closed lower after trading up the previous three sessions. July soymeal made it a fourth trading session higher, and wheat remains on a tear with a fifth trading session closing higher. The mood around wheat sees supply concerns developing in North America and in t...

Cow-calf producer margins are discussed less frequently in these pages than their downstream counterparts of feedlot and beef packer margins, but this doesn’t mean they are less important to understanding the beef industry’s current state and outlook. Additionally, discussion of thi...

Cow-calf producer margins are discussed less frequently in these pages than their downstream counterparts of feedlot and beef packer margins, but this doesn’t mean they are less important to understanding the beef industry’s current state and outlook. Additionally, discussion of thi...