SPREADS

Dec crush trades to 1.34c/bu, new highs, while oilshare trades 48.80%. Dec/March corn trades from 8c to 8 1/2c carry while the Dec 21/22 inverse trades from 7 1/2c to 5c. Dec/March wheat trades from 12 1/2c to new lows of 13c. Dec wheat/corn trades from 2.12c down to 2.07 1/2c. Nov/Jan bean spread trades from 10 1/4c to 10 3/4c, while Nov 21/22 trades from 3c inverse to 1 3/4c. Nov/March beans trades from 18 3/4c to 19 1/2c.

PALM OIL

Cash offers for Nov. are up $35/mt ending at 1.282.50/mt and 1.285.00/mt, respectively. Ahead of the Malaysian Palm Oil Board data to be released on October 11, analysts are forecasting Sep. production at 1.75 mmt, up 2.8% from the prev. wk. Sep. exports are projected at 1.625 mmt, up 39.8% vs. August, with ending stocks at 1.868 mmt, down 0.4% month to month.

NEWS

Stocks are 300 pts lower with crude oil trading down to $78.17/barrel, and the US dollar firmer at 94.44.

CALLS

Calls are as follows:

beans: 1-3 higher

meal: 80-1.50 higher

soyoil: 55-65 pts higher

corn: 2 1/2-3 higher

wheat: 5-8 higher

TECHNICALS

November Beans: Seasonally beans tend to begin to establish their lows, but so far the market has yet to do so. The market needs a close over $12.65 to get back on track for a sideways trading range. However, the reversal from $12.31 may have legs, and if pullbacks towards $12.40 hold the rally could extend higher.

first support: $12.42/$12.45

resistance: $12.55/$12.60

possible range: much the same or lower

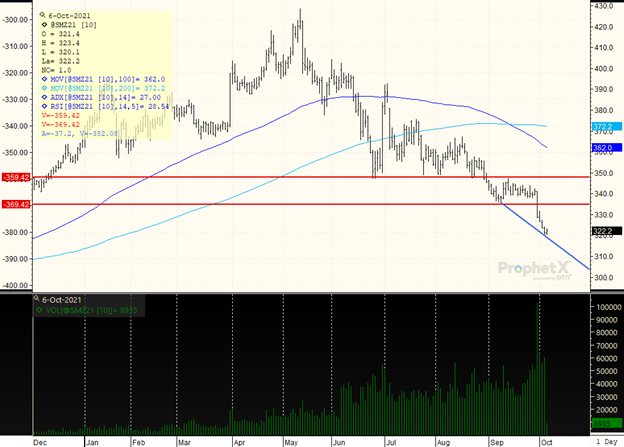

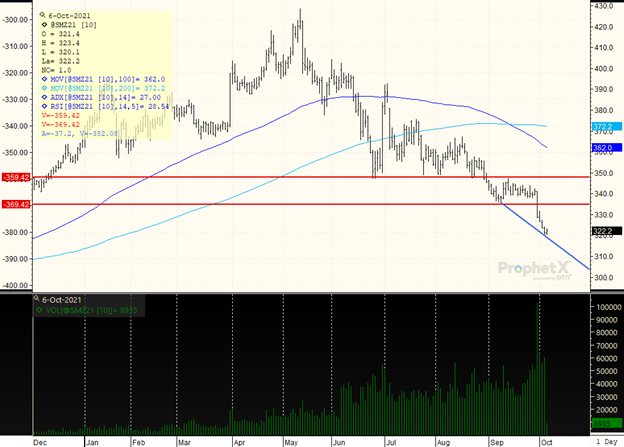

December Meal: Hit a target low at $320.00 but has not bounced very far from it. Trendline support on a further break crosses at $318.00/$319.00 and if we go there think it would hold. Would look for prices to likely head into a $320.00-$340.00 trading range, and if needing to price this is still a good opportunity.

first support: $319.50/$320.00

resistance: $324.00/$325.00

possible range: much the same

December Soyoil: Bullish price action with a quick rally over the targeted high of 6020c which is also the 100-day moving average. The close was constructive, near the high of the PM session at 6179c. Would look to now target 62c-6250c, which could keep beans nicely supported as well. A pullback to 60c would be a buying opportunity.

first support: 6050c/6080c

resistance: 62c-6220c

possible range: 6150c - 6220c or higher

December Corn: Trading range from $5.30 - $5.48, with trendline support today crossing at the low of $5.34. The market retains a decent bid, and is currently sitting in a small uptrend channel. The market has the potential to target $5.45/$5.50, and eventually hit $5.60 if trade continues to settle over $5.35.

first support: $5.33/$5.35

resistance: $5.44/$5.45

possible range: much the same

December Wheat: Trading range is from $7.25-$7.65, and a pullback towards $7.40 is holding. In the big picture the pullback from the high trade at $7.63 1/2 is fairly shallow which is constructive for the market, and friendly price action for the chart. Would look to therefore challenge $7.55/$7.60 again, as a weaker market would have already fallen below $7.20.

first support: $7.40/$7.42

resistance: $7.52/$7.55

possible range: much the same

DECEMBER MEAL

The downtrend continues with new lows at $320.10. The market is now oversold with an RSI at 28%, (anything under 30% is trending into oversold territory), but that is not low enough to necessitate a correction. The market has yet to put in a solid trade indicating that the season low is placed. The ADX is strengthening at 27, (anything over 25 is a stronger trend), indicating that sellers will be there on rallies. Technically the market is weak but could begin to see a rebound from $320.00 with a rally back to at least $335.00/$340.00. Would look for the beginning of a $320.00-$340.00 trading range.

TAGS – Feed Grains, North America

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...