SPREADS

Dec crush trades higher to 1.28c/bu while oilshare firms up to 47.54%. Dec/March corn trades out to 9c from 8 1/2c. Dec 21/22 inverse trades down to 5 1/4C from 7 3/4c. Dec/March wheat widens out to 12c from 11 3/4c. Dec wheat/corn trades from 2.18 1/2c to 2.08 3/4c. Nov/Jan bean carry widens out to 10 1/2c from 10 1/4c, while Nov 21/22 trades out to 3 1/2c carry from 1c inverse. Nov/March widens out to 20c from 19 1/4c.

PALM OIL

Dec palm jumps to a record higher over 4,700 ringgit/mt on the back of higher crude and as market survey pointed tightening Sep ending stocks and mediocre production. Dec. up 159 ringgits to 4,742 ringgit/ton.

NEWS

Stocks are up 180 pts. as crude oil trades up to $78.74/barrel. The US dollar trades to 94.04.

CALLS

Calls are as follows:

beans: mixed/firm

meal: 1.50-1.80 lower

soyoil; 70-80 pts higher

corn: 2 1/2-3 lower

wheat: 5 1/2-6 1/2 lower

canola: 10.00-11.00 higher

BUSINESS

no business reported.

DELIVERIES

Soyoil: 4 - Bunge stopped 3

TECHNICALS

November Beans: Major direction is sideways /lower, and the market hit a new low this AM at $12.31. New lows beget new lows, and the market is beginning to head into a slightly oversold status. Resistance now moves down to $12.45/$12.50 on a bounce, and the target low is $12.15/$12.18. Look for the market to challenge its new low today at the start of the session.

first support: $12.28/$12.32

resistance: $12.38/$12.40

possible range: 12.28-$12.38 or lower

December Meal: Chart is extremely weak and vulnerable to new lows. Rallies are limited as prices work lower. The new low is now $321.40, and resistance moves down to $332.00-$335.00. The chart has yet to set off a good reversal signal, which may imply there is further weakness ahead.

first support: $320.00/$321.00

resistance: $325.00/$326.00

possible range: much the same

December Soyoil: Trading range is from 55c to 60c. The market has formed a new line of support, and that low crosses at 58c should we go there. Trade past 5970c would allow prices to quickly target 60c. Think in time we go there, and pullbacks will be buying opportunities.

first support: 5880c/59c

resistance: 5980c/60c

possible range: much the same or lower

December Corn: Sideways trading range in a congestion phase from $5.30-$5.48. Any trade below $5.30 would open the door to more fund selling, and widen the range to the downside. For now, the chart is more friendly in scope with a possible target high of $5.55/$5.60 if prices can remain over $5.35. Today is a good test for that.

first support: $5.32/$5.33

resistance: $5.38/$5.42

possible range: much the same

December Wheat: Prices are back-tracking after posting a high for the rally at $7.63 1/2. Would look for a pullback towards $7.35 to offer up a good level at which to exit a short or own the market for a possible trip towards $7.75/$7.80. Good support and lower end of the trading range also moves up to $7.25.

first support: $7.40/$7.42

resistance: $7.55/$7.58

possible range: $7.45-$7.60 or lower

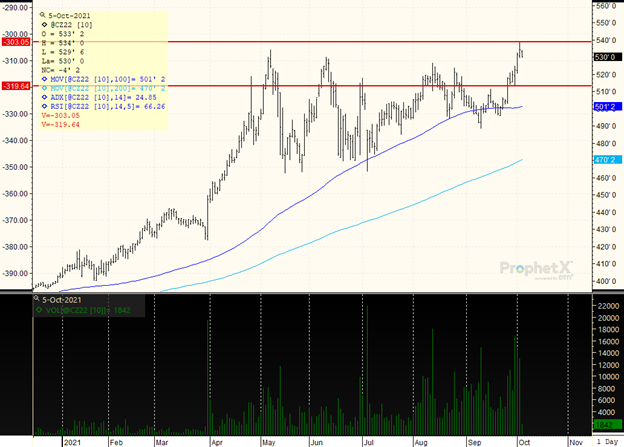

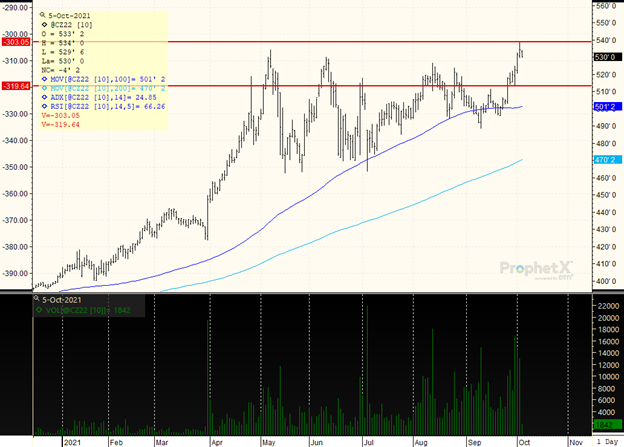

DECEMBER 2022 CORN

The market set a new trading range high at $5.38 3/4, with lower support now moving up to $5.15. The path of least resistance is higher, and we could ultimately test the top of the trading range again. The market is at a 66% RSI, meaning it is neither overbought nor oversold. The uptrend has strengthened with an ADX of 24, (anything around 25 shows a stronger trend), so pullbacks are likely to see support. Look for prices to target $5.50 on a further rally.

TAGS – Feed Grains, North America

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...