SPREADS

Dec crush trades to 1.36c/bu while oilshare trades to new highs at 49.47%. Bean spreads are weaker as November contracts continue to roll forward. Nov/Jan bean carry trades from 11c to 11 1/2c, while Nov 21/22 trades from 1 3/4c to 6 3/4c carry. Nov/March bean spread trades out to 21 1/4c. Dec/March corn trades from 8 3/4c to 9c, while the Dec 21/22 inverse trades from 9 1/2c to 6 1/4c. Dec /March wheat trades from 13 1/4c to 13 3/4c carry. Dec wheat/corn trades from 2.06 1/4c to 2.05c.

PALM OIL

Dec down 27 ringgits/mt. Cash offers down $5/mt.

NEWS

Stocks are up 20 pts. while crude trades to $79.66/barrel. The US dollar trades down to 94.12.

CALLS

Calls today are as follows:

beans: 8-10 higher

meal: .80-1.00 higher

soyoil: 50-60 pts higher

corn: 2 1/2-3 1/2 higher

wheat: 2 1/2-3 1/2 higher

canola: 7.00-8.00 higher

DELIVERIES

Soyoil: 66

BUSINESS

No announcements

TECHNICALS

November Beans: Prices are now stabilizing after reaching a low of $12.31. Lower support moves up to $12.40 and may hold for a further rally today. Would look for pullbacks to hold as prices attempt to now establish a sideways range off the low. Prices can trend towards the 200-day moving average of $12.80, but if so it is a selling opportunity.

first support: $12.48/$12.50

resistance: $12.58/$12.65

possible range; much the same

December Meal: Chart is into new lows under $320.00 at $318.00. Though it is oversold, the chance for further new lows after the open is still there. Target low is now $315.00, and top of the range moves down to $325.00. Rallies continue to be sold, as all of them have failed. There is not yet a good reversal tech signal here, so look for more pressure.

first support: $318.00

resistance: 322.00

possible range: much the same

December Soyoil: Prices hit new highs for the move up at 62.83c. The lower end of the trading range moves up to 58c, and a pullback towards 60c is a short-covering or buying opportunity. Would look for any pullback to 61c to also hold, as the target high moves back to 63c/64c. The chart is very strong, and the successful market walk back to test 60c was successful, setting off buying interest.

first support: 62c/6220c

resistance: 6280c/6320c

possible range: much the same

December Wheat: Prices have been in congestion mode since trading up to $7.63 1/2. A new low was traded today at $7.38, but it could become the low in a market that still wants to move higher. Congesting after a sharp rally higher is typical of bull markets. Target high over $7.60 is $7.78/$7.80.

first support: $7.35/$7.37

resistance: $7.48/$7.50

possible range: much the same

December Corn: Trading range is clearly established from $5.27 - $5.48. The start over $5.30 turns the market slightly higher from a recent test of lows. If the rest of the markets remain firm would look for Dec corn to head back towards $5.40/$5.45 again.

first support: $5.35

resistance: $5.40/$5.41

possible range: much the same

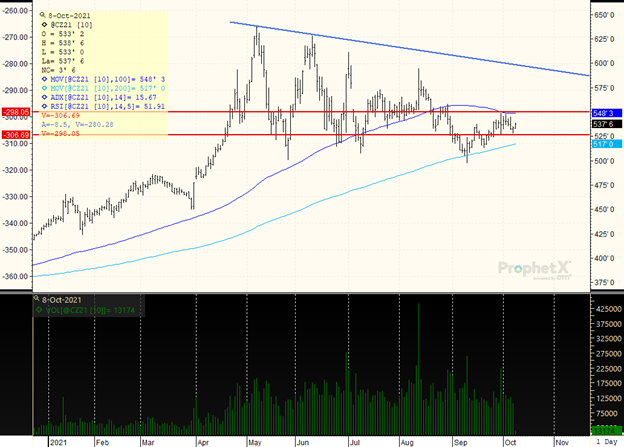

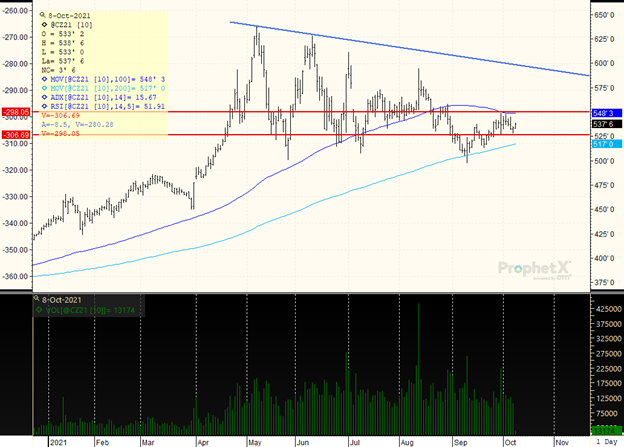

DECEMBER CORN

Establishing a sideways trade now with a weak trend ADX of 15. The chart is now walking back to verify our trading range low, and once again $5.27 was a spot that held. Look for a likely $5.25-$5.48 trading range to continue, and for prices to move back and forth within the red line boundaries, as they have been since the middle of September. Would note that the low volume trade continues as prices chop back and forth in little follow-through to either side.

TAGS – Feed Grains, North America

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Most of the major agricultural commodity contracts opened today’s trading session in the red and stayed that way to the close. Only feeder cattle and lean hogs managed small gains on the day. New contract lows were hit for December soyoil, September SRW and September HRW. Volume was overa...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

Non-Meat: In a first, a Europe-based company has sought EU approval to market lab-grown meat, in this case fake foie gras. Some member states have already banned such products. While lab-grown meat remains expensive, and plant-based meat substitutes have faced declining popularity, the increase...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...

June 2024 total red meat and poultry stocks were up slightly from May but 5.4 percent below June 2023 levels due to sharp declines in poultry and pork stocks. Total poultry stocks were down 7.8 percent year-over-year (YoY) due to reductions in broiler slaughter for the month. Total pork stocks...