Illuminating the value of technical research

On behalf of a commodity producer organization, WPI evaluated the outputs from a project that featured a $5 million investment into technical research over multiple years. WPI’s team captured the results of this extensive effort and synthesized them for presentation to the organization’s governing board; among the findings uncovered and presented for the first time was the development of genomic traits proven, via rigorous testing, to provide crop yield advantages of 50 percent or more to U.S. farmers in times of drought. Capturing measurable results from long-term efforts can be challenging. Educating clients on the dynamics of success measurement when quantifiable results are not readily available requires deep client-consultant collaboration and an ability to consider both near- and long-term client aspirations with market/policy dynamics – attributes that WPI brings to every consulting engagement.

Large supplies and a strong dollar took their toll this week on corn and soybeans, but they still managed to outperform. Weather worries pushed wheat higher for a seventh straight session, and pork finally took a fall. There was high volume trading in corn today but without any strong fee...

Large supplies and a strong dollar took their toll this week on corn and soybeans, but they still managed to outperform. Weather worries pushed wheat higher for a seventh straight session, and pork finally took a fall. There was high volume trading in corn today but without any strong fee...

The Market Brazil has been winning the soybean export war, and imported biodiesel feedstock threatens domestic crush margins, but Chicago trading this week appeared to shake off such concerns. July soybeans traded lower for the past three trading sessions but larger gains achieved at the beginn...

The Market Brazil has been winning the soybean export war, and imported biodiesel feedstock threatens domestic crush margins, but Chicago trading this week appeared to shake off such concerns. July soybeans traded lower for the past three trading sessions but larger gains achieved at the beginn...

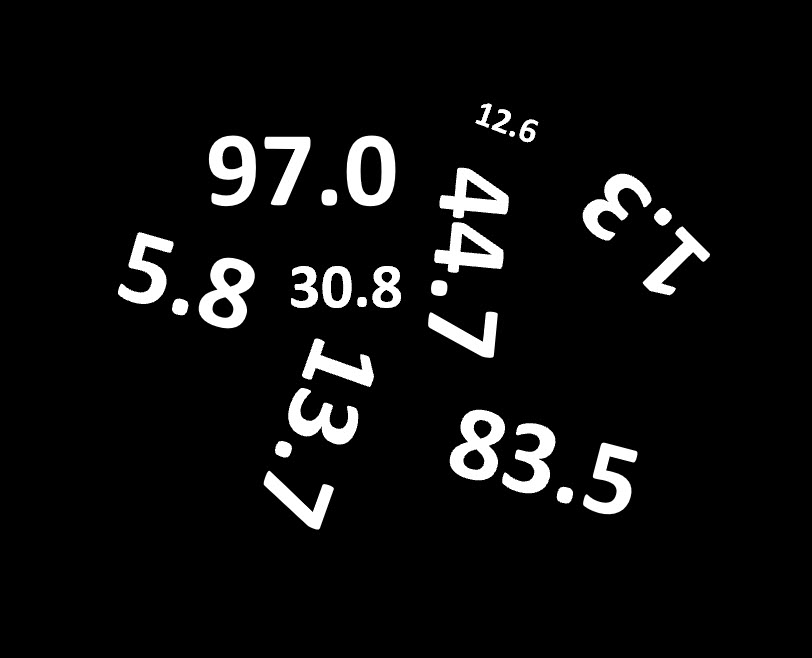

The Q1 2024 GDP was 1.6 percent, well below the pre-report consensus expectation of 2.4 percent, and down from 3.1 percent in Q1 2023 and 3.4 percent in Q4 2023. That rate was the slowest in almost two years, dating back to Q2 2022. Recall that in the 2 February Ag Perspectives report on...

The Q1 2024 GDP was 1.6 percent, well below the pre-report consensus expectation of 2.4 percent, and down from 3.1 percent in Q1 2023 and 3.4 percent in Q4 2023. That rate was the slowest in almost two years, dating back to Q2 2022. Recall that in the 2 February Ag Perspectives report on...